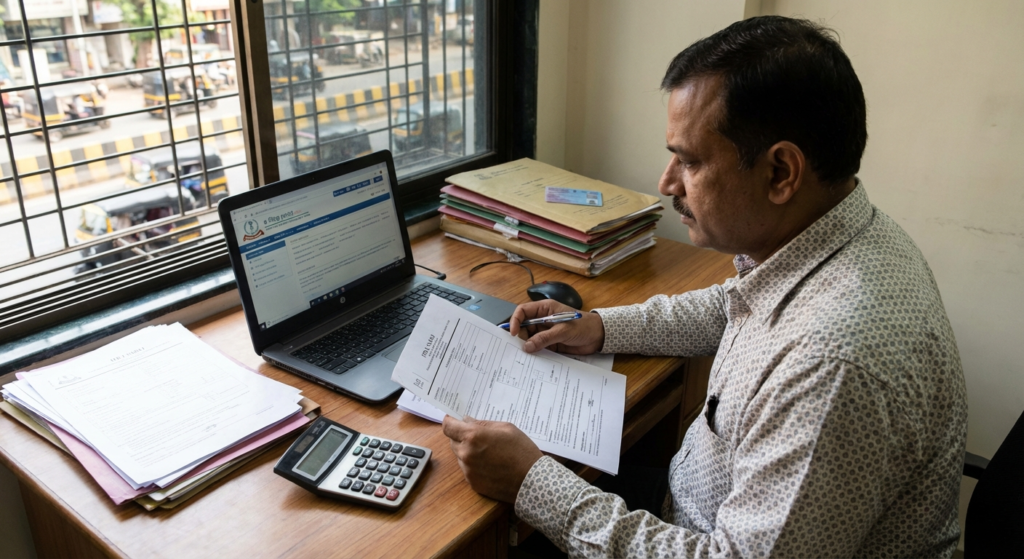

Filing taxes can often feel like navigating a labyrinth without a map. However, understanding the nuances of income tax return filing India is not just a legal obligation but a crucial step towards financial discipline and nation-building. Whether you are a salaried employee, a freelancer, or a business owner, the process of filing your Income Tax Return (ITR) has evolved significantly, becoming more streamlined and digital-friendly over the years.

With the introduction of the new tax portal and updated regimes, taxpayers often find themselves confused about which path to take. This comprehensive guide aims to demystify the entire process of income tax return filing India, ensuring you stay compliant while maximizing your legitimate savings. Let’s dive into the details of how you can file your returns accurately and on time.

Understanding the Importance of Income Tax Return Filing India

Many individuals believe that if their tax has already been deducted at source (TDS), they are exempt from the filing process. This is a common misconception. Income tax return filing India is the mechanism by which you declare your total income to the government, claim refunds for excess tax paid, and carry forward losses. It serves as a definitive proof of income, which is indispensable for various financial activities.

The Income Tax Act mandates that any individual whose gross total income exceeds the basic exemption limit (which varies based on age and the tax regime chosen) must file an ITR. Furthermore, even if your income is below the taxable limit, filing a ‘Nil Return’ is highly recommended for creating a financial track record.

Choosing the Right Form for Income Tax Return Filing India

One of the most critical steps in income tax return filing India is selecting the correct ITR form. Using the wrong form can render your application defective, leading to rejection by the Income Tax Department. The choice of form depends on your source of income, the amount of income earned, and your category (individual, HUF, company, etc.).

ITR-1 (Sahaj)

This is the most common form used for income tax return filing India. It applies to resident individuals having a total income of up to ₹50 Lakhs from salary, one house property, and other sources like interest.

ITR-2

Applicable for individuals and HUFs not having income from profits and gains of business or profession. Use this if you have capital gains, foreign income, or hold directorship in a company.

ITR-3

Designed for individuals and HUFs having income from profits and gains of business or profession. This is complex and requires detailed financial statements.

ITR-4 (Sugam)

For presumptive taxation schemes. Applicable for individuals, HUFs, and firms (other than LLPs) with total income up to ₹50 Lakhs and business income computed under sections 44AD, 44ADA, or 44AE.

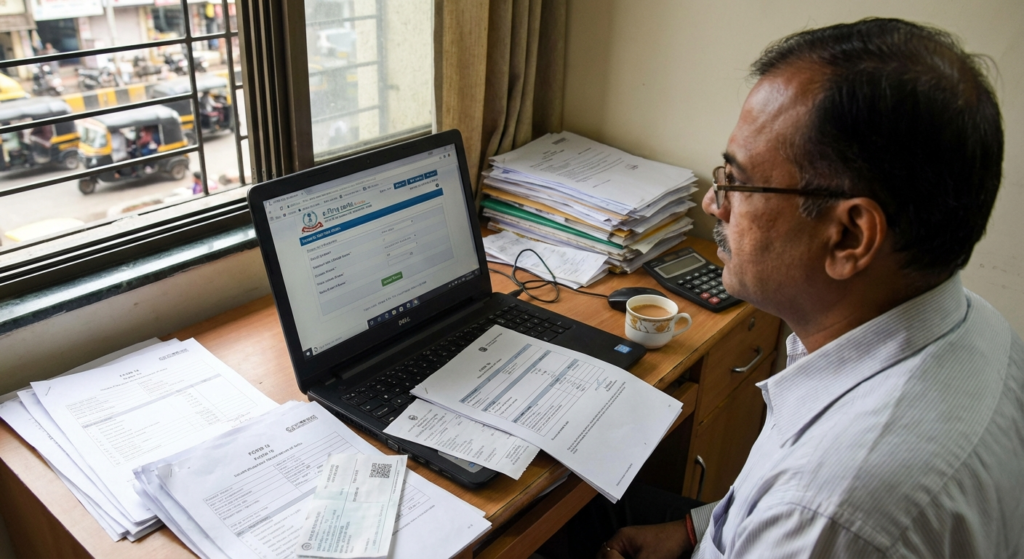

Step-by-Step Process for Online Income Tax Return Filing India

Gone are the days of long queues at the income tax office. The e-filing portal has revolutionized income tax return filing India. Here is a simplified walkthrough of the process:

- Registration: Visit the official e-filing portal. If you are a new user, register using your PAN card. If you are already registered, log in using your ID and password.

- Access the Module: Navigate to ‘e-File’ > ‘Income Tax Returns’ > ‘File Income Tax Return’.

- Select Assessment Year: Choose the current Assessment Year (AY). For example, for income earned in FY 2023-24, the AY is 2024-25.

- Choose Status: Select your status as ‘Individual’, ‘HUF’, or others.

- ITR Form Selection: Based on the criteria mentioned in the previous section, choose the appropriate ITR form. You can often see a pre-filled form based on data available with the department.

- Verification: Verify the pre-filled data, including salary, interest income, and tax payments. Cross-check this with your Form 26AS and AIS (Annual Information Statement).

- Submission: Once confirmed, submit the return and proceed to e-verify using Aadhaar OTP, Net Banking, or by sending a physical copy to CPC Bangalore.

Documents Required for Income Tax Return Filing India

Preparation is key to a smooth filing experience. Before you sit down for income tax return filing India, ensure you have the following documents handy:

- PAN and Aadhaar: These must be linked.

- Form 16: Issued by your employer containing salary breakdown and TDS details.

- Form 26AS: A consolidated tax statement comprising all taxes deposited against your PAN.

- Bank Statements: To verify interest income. If you want to avoid TDS on interest income in the future, understanding the difference between Form 15G and Form 15H is essential.

- Investment Proofs: LIC receipts, PPF passbook, donation receipts (80G), and tuition fee receipts.

- Capital Gains Statement: If you have traded in shares or mutual funds.

New vs. Old Tax Regime: Making the Choice

A significant aspect of income tax return filing India currently is the choice between the New Tax Regime and the Old Tax Regime. The New Regime offers lower tax rates but disallows most exemptions and deductions (like HRA, LTA, 80C). The Old Regime retains higher rates but allows you to claim these deductions.

For the current financial year, the New Tax Regime is the default option. If you wish to opt for the Old Regime to claim your investments, you must explicitly select it during filing. It is advisable to calculate your tax liability under both regimes before proceeding.

Deadlines and Penalties for Late Filing

Timeliness is a virtue the tax department appreciates. The usual due date for filing returns for individuals (non-audit cases) is July 31st of the Assessment Year. Missing this deadline can lead to complications.

If you miss the due date, you can file a ‘Belated Return’ by December 31st, but this comes with a late fee of up to ₹5,000. Furthermore, late filing prevents you from carrying forward losses (except for house property losses). Similar to how businesses face issues with compliance, individuals must be wary of deadlines. For instance, understanding the consequences of delays, such as the TDS late filing penalty, highlights the strictness of tax laws in India.

Common Mistakes to Avoid During Income Tax Return Filing India

Even seasoned taxpayers make errors. Here are a few to watch out for during your income tax return filing India:

- Incorrect Personal Details: Ensure your bank account number, IFSC code, and email ID are correct for refunds and communication.

- Ignoring Form 26AS/AIS: Mismatch between your claims and the department’s data is the primary cause of defective notices.

- Not Reporting All Income: Many forget to report savings bank interest or income from a previous employer.

- Choosing the Wrong Assessment Year: This is a frequent clerical error that invalidates the return.

The Benefits of Filing ITR

Beyond compliance, income tax return filing India offers tangible benefits:

Loan Approval

Banks require the last 3 years’ ITR receipts as proof of income for home and car loans.

Visa Processing

Embassies of developed countries often ask for ITR proofs to verify your financial standing.

Claiming Refunds

If excess TDS was deducted, filing an ITR is the only way to get that money back from the government.

For authoritative updates and specific circulars, always refer to the Income Tax Department of India official website. Additionally, reliable financial news outlets like The Economic Times Tax Section provide timely updates on policy changes.

Conclusion

Mastering income tax return filing India is not about becoming a tax expert overnight; it is about being aware, organized, and compliant. By choosing the right forms, keeping your documents ready, and adhering to timelines, you can ensure a stress-free tax season. Remember, the goal of the tax system is to facilitate national growth, and your contribution plays a vital role. Start your preparation early, double-check your data, and file your returns with confidence.

FAQs

If your gross total income is below the basic exemption limit (Rs 2.5 Lakh or Rs 3 Lakh depending on the regime/age), it is not mandatory. However, if your income is between the basic limit and Rs 5 Lakh, you must file to claim the rebate u/s 87A, reducing your tax to zero.

Yes, you can file a Belated Return usually until December 31st of the Assessment Year. However, this attracts a late filing fee and penal interest on unpaid taxes.

If you discover an error after filing, you can file a ‘Revised Return’ u/s 139(5) before the end of the Assessment Year or before the assessment is completed, whichever is earlier.

You only need to send the physical copy if you have not e-verified your return using Aadhaar OTP or Net Banking. If e-verified, the process is complete online.

It depends on your investments. If you have significant deductions (Home Loan, Section 80C, Insurance), the Old Regime might save you more tax. If you prefer liquidity and fewer investments, the New Regime offers lower rates.