Understanding the Official Stance on GST Registration Fees India

Starting a new business or expanding an existing one in India often requires mandatory Goods and Services Tax (GST) registration. While the compliance benefits of GST are clear, many entrepreneurs are left scratching their heads when trying to determine the actual GST registration fees India. The confusion arises because while the government itself does not charge a fee for the application, significant costs are often involved, primarily related to professional assistance and mandatory requirements.

Let’s establish the core fact immediately: The official government fee for filing the GST registration application through the GST Portal is zero (Nil). The GST Network (GSTN) facilitates this process entirely free of charge. This is crucial for businesses opting for the Do-It-Yourself (DIY) route.

However, running a business means valuing time and accuracy. For most MSMEs and growing enterprises, the complexity of documentation, jurisdictional issues, and potential errors during the application process make professional help indispensable. This is where the perceived GST registration fees India come into play – professional service charges, not government levies.

Why Do Businesses Incur GST Registration Fees from Professionals?

While the actual filing is free, the process involves technical steps, mandatory document preparation, and adherence to specific rules (like the requirement for a physical verification in certain cases). Chartered Accountants (CAs), Company Secretaries (CSs), and tax consultants charge fees for their expertise. These services ensure:

- Accurate classification of the business (e.g., regular scheme, composition scheme).

- Correct preparation and verification of required documents (PAN, Aadhar, Address Proof, Bank details).

- Timely submission of the application (FORM GST REG-01).

- Handling queries raised by the GST officer (clarifications or physical verification requests).

Choosing a reliable consultant minimizes the risk of rejection, which can delay operations and potentially lead to losses.

The Official Cost (Government)

Cost: INR 0 (Nil)

This fee structure applies when a taxpayer registers directly on the GSTN portal without any external professional assistance. All required forms (REG-01, REG-02, etc.) are available freely.

Mandatory Associated Costs (If Applicable)

Digital Signature Certificate (DSC): Ranging from INR 800 to INR 3,000 depending on the class and validity.

DSC is mandatory for companies, Limited Liability Partnerships (LLPs), and Foreign Companies seeking GST Registration. This is often the only required non-professional expense.

Professional Service Charges (Consultant/CA)

Range: Typically INR 2,000 to INR 8,000+

This highly variable fee covers document collation, application filing, follow-up, query resolution, and expert advice tailored to the business structure and state requirements.

Factors Influencing Professional GST Registration Fees India

The total outlay for GST registration fees India is highly dependent on the complexity of your business structure and the scope of services you require. It is rarely a fixed price across the board.

Complexity of Business Structure

The type of entity registering significantly impacts the effort required by the professional, which translates directly into fees. Registering a sole proprietorship is generally simpler than registering a Private Limited Company or a complex partnership firm operating in multiple states.

- Sole Proprietorship: Minimal documentation, usually lower fees.

- Partnership/LLP: Requires partnership deed, authorized signatory resolution, and DSC (for LLP).

- Company: Requires Memorandum of Association (MOA), Articles of Association (AOA), Board Resolution, and mandatory Class 2/3 DSC.

Furthermore, registering for specialized categories, such as Non-Resident Taxable Person (NRTP) or Input Service Distributor (ISD), involves significantly more complex rules and documentation, leading to higher professional GST registration fees India.

Geographical Scope and Multiple Registrations

If your business operates from multiple states, you require separate GST registrations for each state where you have a ‘place of business.’ A consultant handling registrations in 5 states will naturally charge a multiplied fee compared to a single-state registration. This multi-state complexity requires coordinating different state tax authorities and potentially dealing with varied local requirements.

“The true cost of GST compliance isn’t the registration fee itself, but the assurance that your registration is error-free, preventing costly future penalties.” – Tax Compliance Expert.

Comparing DIY vs. Expert Assistance Costs

While handling your GST registration yourself eliminates professional fees, it introduces the risk of errors that can severely impact your business operations later on. If you are a micro-business owner with a simple structure, DIY might be feasible. For growing businesses, expertise offers better long-term value.

DIY Approach: Low Initial Cost

Pros: Zero direct service fees. Complete control over the process.

Cons: Steep learning curve. High risk of procedural errors leading to rejection. Time-consuming, diverting focus from core business activities. You must understand jurisdictional specifics and document requirements thoroughly.

Expert Assistance: Higher Initial Investment

Pros: Guaranteed accuracy and speed. Expert handling of queries and document preparation. Minimizes rejection risk. Saves valuable entrepreneurial time.

Cons: Incurs professional service fees (the primary component of GST registration fees India). Requires careful selection of a reliable consultant.

Timeline and Hidden Costs: Beyond Initial GST Registration Fees India

Understanding the timeline is crucial, as delays can equate to lost business opportunities. The average time taken for successful GST registration, provided all documents are in order, is typically 3 to 7 working days.

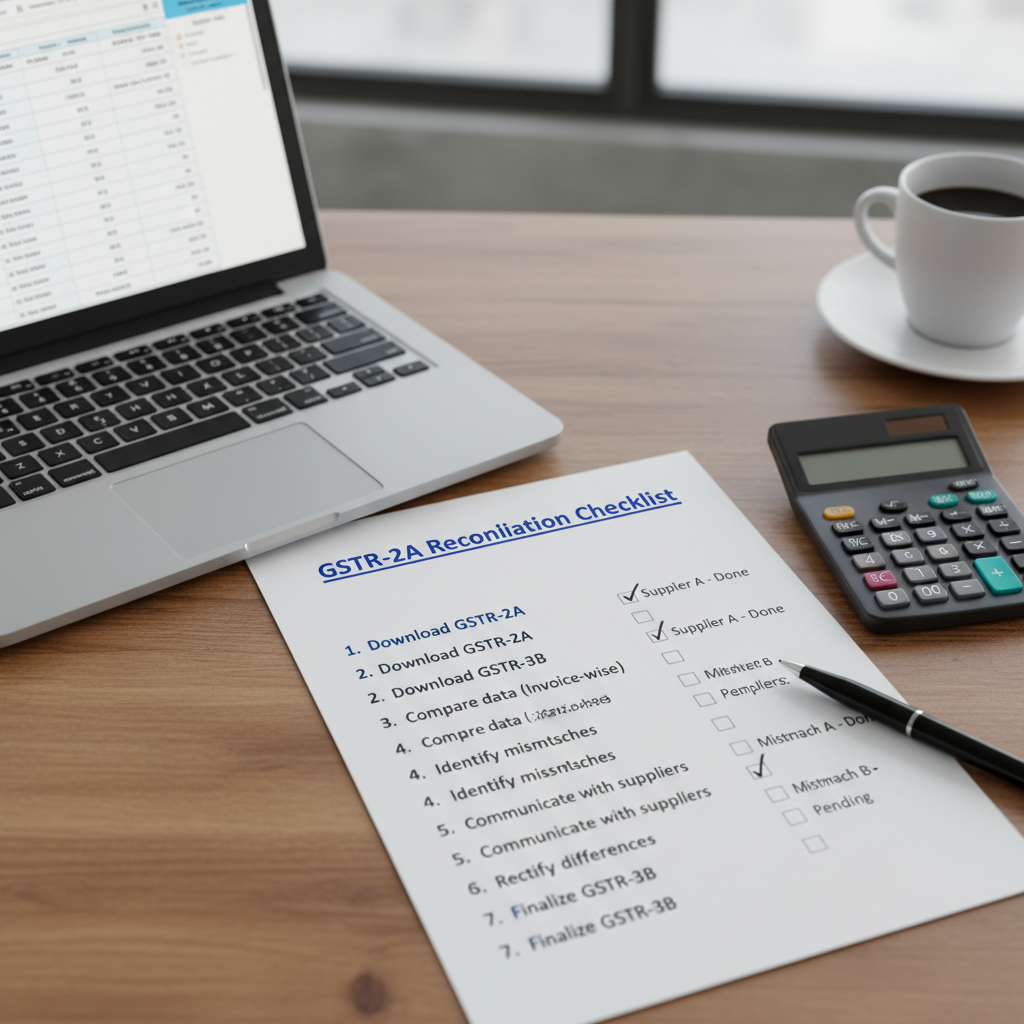

The Role of Document Verification

The speed depends heavily on the GST Officer’s verification process. If the documents are clear and the details match the government database (especially PAN and Aadhar), approval is fast. If discrepancies arise, the officer issues a query (FORM GST REG-03), requiring clarification within 7 working days. Failure to respond adequately or on time can lead to rejection (FORM GST REG-05), forcing you to start the process again and potentially incurring additional professional fees.

The Cost of Future Compliance

Once registered, the fees don’t end. Compliance is mandatory, and penalties for non-compliance are severe. A key consideration when calculating the total cost of GST compliance is the necessity of ongoing filing and adherence to rules, such as those governing the generation of E-Way Bills. Understanding E-Way Bill rules is essential for businesses involved in the movement of goods.

According to the Central Board of Indirect Taxes and Customs (CBIC), failure to file returns on time attracts late fees, which accrue daily. You can find detailed information on these penalties on the official CBIC website.

Hidden Cost 1: Opportunity Cost of Delay

If registration is delayed due to errors or documentation issues, you cannot legally issue proper GST invoices, potentially losing major B2B clients who require input tax credit eligibility. This loss of business is often far greater than any professional fee.

Hidden Cost 2: Software and Infrastructure

While not strictly a registration fee, managing GST compliance efficiently often requires accounting software or GST Suvidha Provider (GSP) services. These subscriptions can range from a few thousand rupees annually to much higher costs for enterprise solutions.

Hidden Cost 3: Penalties for Errors

If a professional makes an error in classifying your business or selecting the wrong jurisdiction, correcting this later can involve complex rectification processes, often incurring fresh professional fees or, worse, attracting penalties for incorrect declaration.

Common Mistakes That Increase Your Overall GST Registration Fees India

The most common reason entrepreneurs end up paying more than necessary is due to simple, avoidable errors during the initial application phase. These mistakes necessitate re-work, re-filing, or paying professionals to resolve complex issues.

- Inaccurate Principal Place of Business: Declaring a place of business without adequate proof of ownership or tenancy (e.g., electricity bill, rent agreement). If the officer initiates physical verification and finds discrepancies, the application is rejected.

- Mismatch in PAN/Aadhar Details: The data entered must exactly match the details registered with the Income Tax Department and UIDAI. Even minor spelling errors or discrepancies in the date of birth can halt the process.

- Incorrect Authorized Signatory Details: Failing to upload the necessary resolution or letter of authorization for the designated signatory.

- Choosing the Wrong Scheme: Applying for the Regular Scheme when the Composition Scheme is more beneficial (or vice versa), leading to mandatory amendments or re-registration later on, which involves professional charges.

To summarize the financial landscape, while the government maintains a policy of zero GST registration fees India, the practical expenditure involves ensuring your compliance is robust and future-proof. Investing in quality professional service upfront is an investment in minimizing future legal and penalty costs.

It is recommended that businesses always verify the credentials of their chosen consultant and insist on a clear breakup of the professional service charges versus any mandatory government or third-party costs (like DSC). Transparency is key when dealing with professional fees.

For official documents and forms related to the process, always refer to the official GST Portal of India.

Conclusion

The question of GST registration fees India is best answered by separating official government charges (which are zero) from mandatory associated costs (like DSC) and optional, but highly recommended, professional service fees. For most businesses, the cost associated with hiring an expert, typically ranging from INR 2,000 to INR 8,000, is a prudent investment. This ensures fast processing, minimizes the risk of rejection, and establishes a foundation for seamless ongoing GST compliance, ultimately saving the business significant money and resources in the long run.

FAQs

No, the Government of India, through the GST Network (GSTN), does not charge any application or registration fee for filing the GST registration form (FORM GST REG-01). The official registration process is entirely free of charge.

CAs and tax professionals charge fees for their services, which include verifying and compiling complex documentation, ensuring legal compliance, handling officer queries, accurately filling out the application, and securing timely approval. These professional service fees constitute the majority of the cost for most businesses.

If all documents are correctly submitted and there are no queries from the GST Officer, the registration typically takes between 3 to 7 working days. However, if the officer raises a query (REG-03) or initiates physical verification, the process may extend up to 15 to 21 days.

A Digital Signature Certificate (DSC) is mandatory for GST registration if the applicant is a company (Private Limited, Public Limited, etc.), Limited Liability Partnership (LLP), Foreign Company, or a Foreign LLP. Proprietorships and Partnership Firms can usually use an Aadhaar-based Electronic Verification Code (EVC) instead, but DSC is highly recommended for security.

This depends entirely on the agreement with your consultant. Reputable consultants often offer re-filing assistance within their initial fee structure if the rejection was due to a correctable error. However, if the rejection is due to lack of cooperation or non-submission of necessary documents by the client, additional charges for re-application may apply.

Read Also:

- Understanding the TDS Late Filing Penalty: Section 234E Fees and Section 271H Consequences

- Understanding the Belated ITR Filing Process: Penalties, Steps, and Compliance Essentials

- Essential Guide to GST Compliance: Everything **GST for Ecommerce Sellers** Need to Know

- The Complete Guide to ITR e Verification Steps: Methods, Benefits, and Troubleshooting