Introduction to NGO Tax Exemptions in 2026

Starting a non-governmental organization (NGO) in India is a commendable step toward social change. However, to ensure that your mission remains financially viable and attractive to supporters, navigating the legalities of the Income Tax Act is essential. The 12A and 80G registration process for NGO is the gold standard for non-profits seeking to maximize their resources. Without these registrations, an NGO is treated like a normal taxpayer, and its donors receive no tax incentives for their contributions.

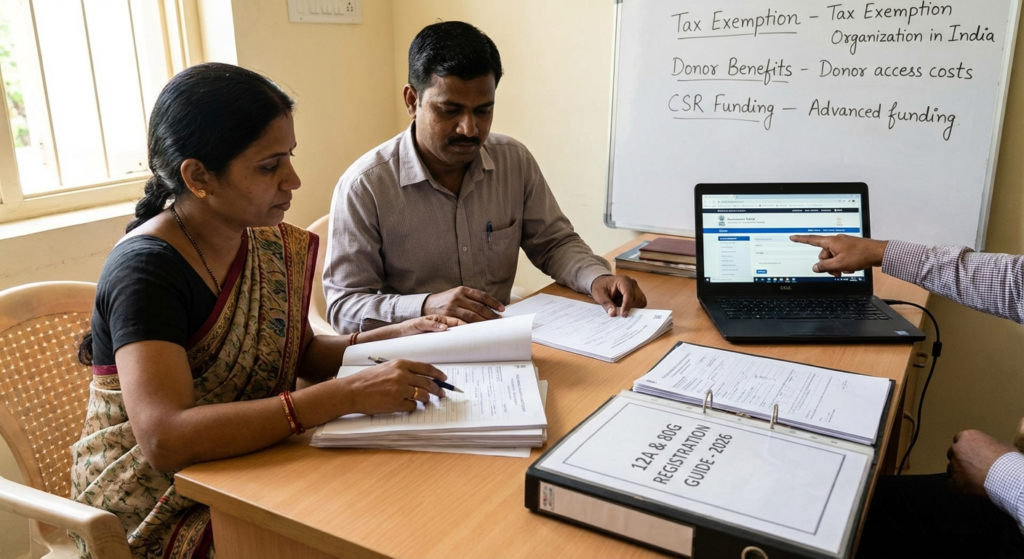

In the current regulatory environment of 2026, the government has streamlined the digital application process, making it more transparent yet strictly monitored. Understanding the nuances of the 12A and 80G registration process for NGO will help your organization secure tax-exempt status on its income and provide a 50% tax deduction to your donors under Section 80G. This guide provides a comprehensive roadmap to achieving these milestones efficiently.

Understanding the 12A and 80G Registration Process for NGO

To the uninitiated, these alphanumeric codes might seem confusing. In simple terms, Section 12A and Section 80G are two separate registrations under the Income Tax Act, 1961, that serve different but complementary purposes. While 12A benefits the NGO itself, 80G benefits those who donate to the NGO.

What is 12A Registration?

Section 12A is a one-time registration (now subject to renewal every five years) that grants an NGO exemption from paying income tax on its surplus funds. Normally, any entity earning income must pay tax, but since NGOs work for the public good, the government allows them to reinvest their entire income into their charitable activities without tax leakage. Obtaining this status is the first step in the 12A and 80G registration process for NGO.

What is 80G Registration?

Section 80G is designed to encourage philanthropy. When an NGO holds an 80G certificate, its donors can claim a deduction from their taxable income. This makes your NGO a preferred choice for corporate social responsibility (CSR) initiatives and individual philanthropists. After completing your 12A 80G Registration, your organization gains a significant competitive edge in fundraising.

12A Benefits

Allows the NGO to claim full tax exemption on its income, provided the funds are used for charitable purposes. It also helps in qualifying for various government grants.

80G Benefits

Provides a tax deduction to donors (usually 50% of the donated amount), which acts as a powerful incentive for people and companies to contribute to your cause.

Combined Impact

Together, they build immense credibility and trust, signaling to the world that your NGO is legally compliant and transparent in its financial dealings.

Eligibility for the 12A and 80G Registration Process for NGO

Before diving into the application, it is crucial to ensure your organization meets the eligibility criteria set by the Income Tax Department. Not every non-profit qualifies automatically. The department scrutinizes the objectives and activities of the entity to ensure they are purely charitable.

- Charitable Objectives: The NGO’s primary goal must be charitable, such as education, relief for the poor, medical relief, or environmental preservation.

- No Private Benefit: The assets and income of the NGO must not be used for the personal benefit of the trustees or members.

- Proper Bookkeeping: The organization must maintain regular books of accounts and get them audited annually.

- Non-Religious Nature (for 80G): While 12A can be granted to religious trusts, 80G is generally reserved for secular charitable organizations that do not spend more than 5% of their income on religious activities.

Many organizations also look into NITI Aayog registration benefits to further enhance their eligibility for government funding and schemes alongside their tax-exempt status.

Documents Needed for 12A and 80G Registration Process for NGO

Documentation is the backbone of a successful application. Any discrepancy here can lead to rejection or long delays. In 2026, all documents must be uploaded in digital format on the e-filing portal.

Core Documentation Checklist

- Registration Certificate: A certified copy of the Trust Deed, Memorandum of Association (MOA), or Incorporation Certificate for Section 8 companies.

- PAN Card: A copy of the PAN card issued in the name of the NGO.

- NOC from Landlord: If the registered office is on rented premises, a No Objection Certificate from the owner is required.

- Activity Report: A detailed report of the activities carried out by the NGO since its inception or for the last three years.

- Financial Statements: Audited balance sheets and profit/loss accounts for the preceding three years (or since inception if the NGO is newer).

- Trustee Details: Names, addresses, and PAN details of all trustees or members of the governing body.

Step-by-Step 12A and 80G Registration Process for NGO

The application process is now entirely online. It is managed through the Income Tax Department’s e-filing portal. In 2026, the process is divided into two phases: Provisional Registration and Final Registration.

Phase 1: Provisional Registration (Form 10A)

New NGOs or those applying for the first time must apply for provisional registration. This is granted for a period of three years without an intensive initial inquiry. The goal is to allow new organizations to start their work and build a track record.

Phase 2: Final Registration (Form 10AB)

Once the NGO starts its activities, or at least six months before the expiry of the provisional registration, it must apply for final registration using Form 10AB. This registration is valid for five years and involves a more detailed scrutiny of the NGO’s actual charitable work.

Step 1: Portal Login

Log in to the Income Tax e-filing portal using the NGO’s credentials. Navigate to ‘e-File’ and then ‘Income Tax Forms’.

Step 2: Form Selection

Select Form 10A for provisional registration. Fill in the required details regarding the trust, its objectives, and its members.

Step 3: Upload & Verify

Upload the scanned PDF copies of the required documents. Use a Digital Signature Certificate (DSC) or EVC to verify the submission.

Step 4: Order Issuance

The Commissioner of Income Tax (CIT) will review the application. If satisfied, an order granting registration will be issued electronically.

Timeline and Fees for the 12A and 80G Registration Process for NGO

One of the most common questions is how long the 12A and 80G registration process for NGO takes. Generally, the provisional registration (Form 10A) is processed quite quickly, often within one month of filing. However, the final registration (Form 10AB) can take up to six months as the authorities may request additional clarifications or a physical visit to the NGO’s premises.

Regarding fees, there is no direct government fee for filing Form 10A or 10AB on the portal. However, NGOs usually incur costs related to professional consultancy, auditing of accounts, and digital signatures. It is advisable to consult with experts to ensure the application is error-free, as a rejection can set your timeline back significantly.

Common Challenges and How to Overcome Them

The 12A and 80G registration process for NGO is not without its hurdles. Many applications are rejected due to technical errors or lack of clarity in objectives. For instance, if the Trust Deed does not contain an “Irrevocability Clause” or a “Dissolution Clause,” the application might be flagged. Ensure your legal documents are drafted by professionals who understand the specific requirements of the Ministry of Corporate Affairs and the Tax Department.

Another challenge is the timely filing of Form 10BD. NGOs with 80G registration must now file an annual statement of donations (Form 10BD) and issue certificates (Form 10BE) to donors. Failure to do this can result in heavy penalties and the potential cancellation of the 80G certificate.

If your organization is planning to apply for government tenders, you should also learn how to apply for NGO Darpan grant, as the Darpan ID is often a prerequisite alongside your tax registrations.

Conclusion

Securing 12A and 80G status is a transformative milestone for any non-profit. The 12A and 80G registration process for NGO in 2026 demands meticulous planning, accurate documentation, and a genuine commitment to charitable objectives. By following the steps outlined in this guide, your NGO can unlock significant tax savings and attract the funding necessary to create a lasting social impact. Remember, compliance is not a one-time task but a continuous journey of transparency and accountability.

Frequently Asked Questions

It is not mandatory to register an NGO, but it is highly recommended. Without 12A, you pay tax on your income, and without 80G, you cannot provide tax benefits to your donors, making it very difficult to raise funds.

Yes, a newly established NGO can apply for provisional 12A and 80G registration immediately after its incorporation. This provisional registration is valid for three years.

Provisional registration is valid for 3 years, while final registration is valid for 5 years. You must apply for renewal at least six months before the expiry of the current certificate.

Yes, you can apply for both 12A and 80G registrations simultaneously on the Income Tax portal. They are filed using separate forms (usually both via Form 10A for new registrations) but can be processed around the same time.

Missing the renewal deadline can lead to the cancellation of your tax-exempt status. The NGO might be required to pay tax on its accumulated income at the maximum marginal rate, which can be financially devastating.

Read Also:

- GST Registration for Ecommerce Sellers India: A Comprehensive Compliance Guide 2026

- AOC-4 Due Date for F.Y. 2023-24: Filing Deadline

- Mastering the GST Annual Return GSTR-9 Filing Process: A Comprehensive Guide

- The Definitive Guide to LLP to Private Limited Company Conversion: Process and Requirements